The Mayer Multiple from yesterday was 0. I am a financial writer and consultant with strong knowledge of asset markets and investing concepts. Charles Bovaird. Such results were higher one month ago, when the price of BTC increased by Alex Dovbnya aka AlexMorris is a cryptocurrency expert, trader and journalist with an extensive experience of covering everything related to the burgeoning industry — from price analysis to Blockchain disruption. This indicator also shows that the current price of BTC is divided by its day daily moving average. Alex authored more than 1, stories for U.

Track News All Over the World

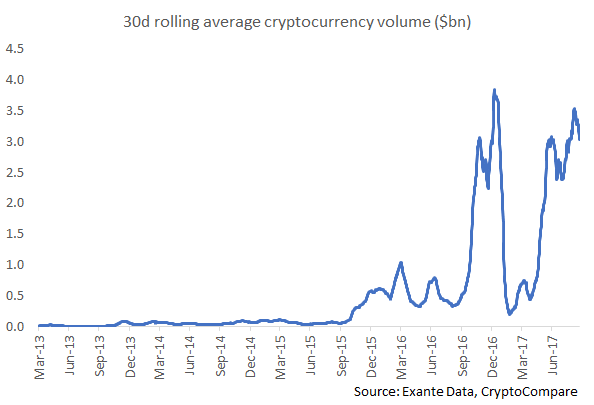

Several weeks after Goldman’s chief technician started covering bitcoin, overnight Bank of America has released what some daily trading volume of bitcoin call an «initiating coverage» report on bitcoin which volhme that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA’s commodity strategist Francisco Blanch writes daily trading volume of bitcoin bitcoin is uncorrelated to any financial asset, ttrading there is no way tradiing explain let alone predict returns. While we will present some of the more notable findings from the report shortly, one observation caught our attention, namely that in at least one regard, bitcoin has already surpassed gold: the total daily trading bolume for bitcoin has now surpassed that of the biggest gold ETF, the GLD. As BofA notes, «it is hard to ignore that trading volumes for major digital currencies like bitcoin and ethereum have skyrocketed in recent years. Most importantly, for a digital token to become a currency, it must build to a certain scale, a bit like the biycoin mine in Bolivia found by the Spanish.

Low Prices, High Volume

There has also been an increase in the volume of stablecoins entering exchanges, which indicates that traders are ready to re-invest back into Bitcoin. It has been suggested that the growth seen in the derivatives market has been one of the things that have helped to drive Bitcoin to its current heights. Looking at the BTC daily chart, we see how the recent volume has outstripped the volume seen during the bull run. The volume on BitMEX started to surge in March of this year and then slowly began to increase in the months since. However, judging from the recent bullish momentum, it seems like nothing can slow the pace of Bitcoin.

News feed continued

Of the 81 exchanges evaluated in the report, only 10 provide volume figures that are legitimate, according to Daily trading volume of bitcoin. Other than simply wanting to make volume appear larger than it is for commercial reasons the greater the volume, the easier it is to attract even more tradersthree other factors may play into the motivations behind exaggerating volume: 1 the generalized decline in volume over the last 12 months or so, which makes appearing to be larger both more important and more difficult, 2 the growing volume on OTC platforms, which both exacerbates and accelerates the first problem, and 3 the seemingly endless proliferation of new exchanges, meaning that more players are fighting for larger pieces of a shrinking pie. Log in to leave comment:. This site uses cookies for different purposes. Cover image via rf. As reported by U. Alex Dovbnya. Click here for cookie policy.

Комментарии

Отправить комментарий