On the other hand, if you are looking for a deep selection of automated trading algos, Live Trader could be a perfect fit. The baselines used to compare the performance of the three models were a buy and hold position on Bitcoin and a basic one feature classification model created by taking the sign of change in price from 10 minutes prior. The bot has integrated with an external trading signaller. Decentralized trading bot platform.

Buying Options

Many traders are moving to become algorithmic traders but struggle with the coding of their trading robots. Often these traders will find online algorithmic coding information disorganized and misleading, as well as offering false promises of overnight prosperity. One source of reliable information is from Lucas Liew, creator of the online algorithmic trading course AlgoTrading The course has excellent reviews and garnered over 8, students since first launching in October The program focuses on presenting the fundamentals of algorithmic trading in an organized way.

Summary of the Best Bitcoin Trading Bots

Here is a detailed analysis of each one and how to best approach selling your coins. Before beginning, it is important to understand that Bitcoin is a relatively new phenomenon. As such, taking care of all aspects of buying, storing, and selling your coins is vital. Additionally, due to the volatile nature of the currency, you should be extremely cautious when making investments and never risk more than a small percentage of your wealth. That being said, because the currency is so volatile , it can be useful for both short and long-term investors. If one approaches this correctly, then the gains can be vast.

1. GRANT OF LICENSE

Successfullg this unusual and mysterious interview, we invite you to learn from the Italian scalper Marco who goes under the pseudonymous Twitter name BitScalp.

Marco started trading forex in Usccessfully was the FX golden age, as Marco put it himself, where everybody was fooled to get quick rich with x, up to x leveraged forex and CFDs, mainly on unregulated and exotic brokers who were taking the opposite side of their clients. I intend to study the feasibility of running a Bitcoin mining facility there because of the cheap electricity. I run some Ethereum GPU miner here but my production cost is just a little below current market rate.

Early on, Bitcoin was only known to be an Internet currency used in the darknet marketplaces. Over the years, I switched to regulated markets, trading Stocks, Options, and finally my love, Futures.

The defragmented, OTC [over-the-counter] and unregulated structure of crypto exchanges is very similar to the foreign exchange market, where a bunch of big players are challenging each other in order to screw the majority of the public. Now that Wall Street and Commercial Banks entered the game, alfo are beginning to see common market-making price patterns typical of forex, where redundant liquidity duplicated limit orders placed on multiple trading venues that are suddenly removed once filled causes fast and violent moves followed by infinite periods of narrow trading ranges.

Technically they are just liquidity holes exploited by momentum ignition algos. I like the fact that I can taste the current market sentiment on Twitter like years ago I was reading market thoughts of other currency traders on Forex Factory and similar ttrading. I know well that HFT [high-frequency trading] Algos are able to read news and retail sentiment in order to take a position, and now that HFT firms are entering the crypto space, we will begin to see their threats to human succcessfully, like last-look and adverse selection practices.

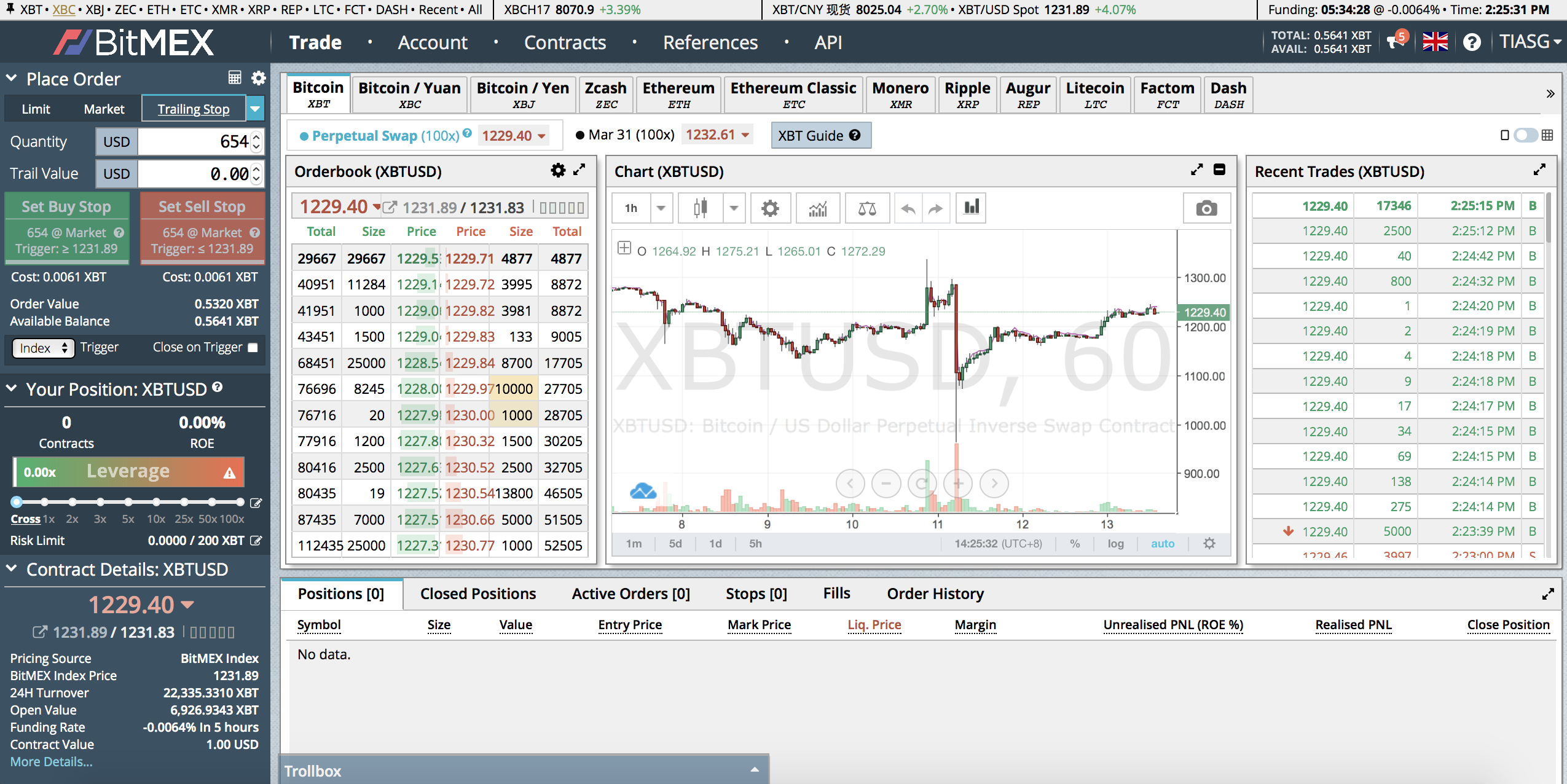

I always have my other Futures and Stock Options trading accounts as my taxed source succsssfully income. The problem is this contract is sho illiquid teading BitMex and you have to be very careful with executions, or slippage will eat up most of your paper profits. Basically, in these markets like the T-note or the EuroStoxx, the price is kept in tight trading ranges most of the time, you can see it on the daily profile chart where most of the days are normal distribution ones.

I look for temporary imbalances in the order book to basically trade a return to the mean. I am a fader. I find it akgo to trade with the trend. Most people are only good at this because they basically lack skills. Everybody is a genius in a bull market, succcessfully They are not traders, their strategy is just to buy and hope.

A trader must be able to gain anytime, in trending as in ranging condition, both on the short and on the long. Bitcoin is far from a stable market. However, when there are no wild swings, does it influence your trading strategy? Bitcoin attracts speculators because of his wild swings. More speculation brings in more liquidity, and more liquidity means less volatility. Eventually, speculation will gift Bitcoin with the so much wished price stability. Many inexperienced traders fell in the overtrading trap during these slow periods.

I learned this lesson in a hard way during my early years of forex, so now I just wait patiently for the next crystal-clear setup instead of messing around with trades made out of boredom. Therefore, I can sleep at night to be ready for the next trading session. I organize my trading differently then I do on Index Futures, where I mainly trade the cash session.

While I sleep I let the stop loss and the profit taker do the job for me. I grab just a few ticks at. On cryptos, however, I have to take longer shots. By the way, order flow reading skills help me get the best executions. The tape tells me if a movement is getting exhausted ahead of time or if a liquidity area is getting eaten up by incoming orders and price is ready to move to the next level. Such systems have a really poor edge you can spot only over hundreds of trades and they usually suffer long drawdown periods.

But bitcoih time to time the losing streak comes and you have to trwding strong and preserve your capital. After the infamous 3 losses, I cut down on my leverage and reduced my risk per trade until I have recovered my equity curve. If I had such a mechanical system, however, I would just hire a programmer to code a trading algo and let the computer do the job.

Our brain is not designed that way, there are millions of nuances in trading and every situation is slightly different from the previous, even if similar. What you have to be consistent at instead, is the size of your bets and the mental discipline to respect your stop points and taking profits when you have to. The tricky part is that there auccessfully be situations where breaking your own rules would have been the right thing to do!

What you must learn to discern if they are your emotions that are making you break own rules, or a new market-generated information. Who is successfully algo trading bitcoin never traded again at these prices after the crash. I gave a try at Binance Altcoins but swing trading is not for me. I need leverage. I can take a dozen leveraged scalps with that capital at risk and have a better return in a shorter period of time.

Furthermore, trading Altcoins is basically like trading pink sheets or low caps but without any sort of fundamental information on the company. The liquidity, by the way, is far better there than on OTC stocks.

Binance market makers algos are doing a great job at keeping these markets active. Maybe I could sell some cash-secured put in the future like I do on stocks if the crypto market will evolve in that sense. Have you studied some fundamental sciences to use it in trading? Like math or social psychology? If yes, how do use this knowledge?

Math was never my best subject at school. You can apply the same principles used in daily charts on intraday traders. Can we assume that most of your knowledge you take from forums and practice? I come from IT and graphic design sector, I have zero financial background. There was a great floor trader who had no idea of the inverse relationship between bond yields and their prices, but he was a master at taking the extreme of the T-Note session while everyone else was puking their positions.

You have to be a bit reckless and you must fully commit yourself in the game above all. Average Joe is too lazy and too afraid to exit his comfort zone. He would never trade his beer and TV for his financial freedom. I was in several chat group of traders, one of them was a prop trader for Futex, the same firm of Nav Sarao. He introduced me to the EuroStoxx contract. He was scalping forex on his personal account while at work! Another one is a great Asset manager who taught me about stock options volatility plays.

Many thanks to Marco aka BitScalp. It was a deep overview of the bitcoin scalping scene and trading psychology. Let us know in the comment section if you liked it. This is part of the Depth of Trading project, a series of inspiring interviews with successful traders. Bookmap Follow. Crypto trader Bennett Stein BitcoinTrad3r has a dedicated Bookmap order flow online educational course. Check out some free materials from the course! Price never traded again at these prices after the crash, as a reminder that price does not always come back to you.

Flashed quotes. Twitter Facebook. Retweet on Twitter Bookmap Retweeted. Read more articles about trading.

Get the Latest from CoinDesk

However, they learn from these mistakes and better themselves through the experience that is gained. No Spam. Club, and enter the info into the fields it provides you. Tassat LLC is […]. Offers high flexibility when it comes to pricing. Share on Facebook Share on Twitter.

Комментарии

Отправить комментарий