This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are mined. Bitcoins may be lost if the conditions required to spend them are no longer known. In actuality, the final bitcoin is unlikely to be mined until around the year , unless the bitcoin network protocol is changed in between now and then. I think another curious question is why the 4 year halving schedule? The dramatic decrease in reward size may mean that the mining process will shift entirely well before the deadline.

What Happens When the Last Bitcoin is Mined?

Bitcoin is like gold in many ways. Like gold, bitcoin cannot simply be created arbitrarily. Gold must be mined out of the ground, and bitcoin must be mined via digital means. Linked ,illion this process is the stipulation set forth by the founders of bitcoin that, like gold, it must have a limited and finite supply. In fact, there are only 21 million bitcoins that can be mined in total.

21 Million Bitcoins Limit

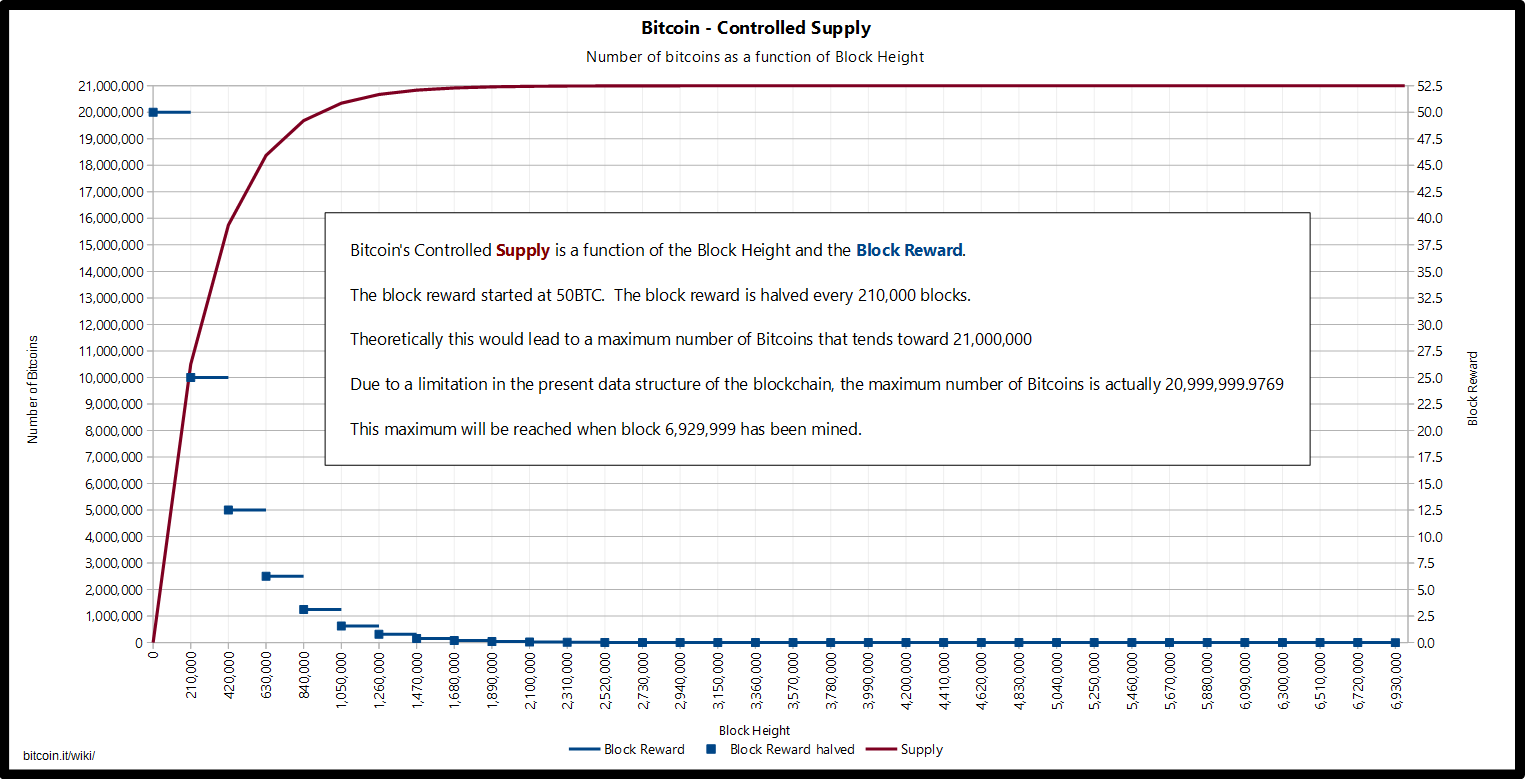

Once miners unearth 21 million Bitcoins, that will be the total number of Bitcoins that will ever exist. Bitcoins can be lost due to irrecoverable passwords, forgotten wallets from when Bitcoin was worth little, from hardware failure or because of the death of the bitcoin owner. This is a pretty important concept to understand in order to fully understand when the last Bitcoin will be mined. Originally, 50 bitcoins were earned as a reward for mining a block. Then it dropped 25 bitcoins, and then to

21 million was an educated guess

Bitcoin was the first fully decentralized digital asset to hit the market. Satoshi put a lot of thought and work into creating Bitcoin but a decade later, there are still two unknowns about this journey. Firstly, no one knows who Satoshi Nakamoto really is.

Also, Satoshi set design for Bitcoin, limiting its production to 21 million. In other words, there will never be more than 21 million Bitcoins produced except something changes. This leads us to the second unknown — no one really knows why a 21 million limit was set. Bitcoin is mined as block rewards for the miners and is set to halve after everyblocks which happens over a four-year period. Currently, miners earn There is one pointer to the figure as seen in a correspondence between Nakamoto and Mike Hearn, a software developer.

Basically, Satoshi tries to explain a desire for some similarity between Bitcoin and Fiat currencies even though the difficulty of that due to possible changes to both currencies in the future was also considered. However, regardless of the intended similarity, Satoshi believed that adoption could drive Bitcoin to be worth a lot more per unit. The above, on some level, explains a little about what Nakamoto had in mind especially with regards to fixing a limit but the real thought or calculation that resulted in 21 million is still a little lost on the cryptosphere.

Some have offered mathematical explanations while some others have expressed more random thoughts. Perhaps the most intriguing explanation what limits bitcoin to 21 million a mathematical one offered by a member of the StackExchange forum.

According to the post, the number of blocks per cycle can be gotten by multiplying 6 blocks produced every hour by 24 hours in a day by number of days in a year and then by 4 number of years in a cycle. This giveswhich is then rounded down toMaybe one day Satoshi Nakamoto will reveal their true identity -ies and then we can ask all the puzzling questions. Bitcoin’s blockchain reached a major milestone on 19 October when the ,th block was mined and the 18th million BTC was officially put into circulation.

Following the mining of the block, whilThe post Bitcoin’s network may have lost over 1. Despite even the most optimistic models falling short of that value, here are five reasons why his prediction may not be so crazy. On Oct 15, for the first time in three years, Bitcoin witnessed a bullish crossover of the and period moving averages on the three-day charts.

Bitcoin miners will mine the 18 millionth BTC this week, leaving just 3 million left to release before mining stops in the distant year Over the last 24 hours, Bitcoin, the first and largest cryptocurrency by market cap, has been witnessing a drop of The victors of the latest tussle between bulls and bears have been decided.

If you are thinking that adoption of Bitcoin has been hyped and real-world use cases are not increasing, Square payment app has news for you. The week is coming to an end and the whales have as usual moved tons of dollars in crypto.

Welcome to Hard Fork Basics, a collection of tips, tricks, guides, and info to keep you up to date in the cryptocurrency and blockchain world. The cryptocurrency market has been incredibly active in the last few weeks. This is a huge bet, as the crypto market is starting to recuperate now but nobody knows fast it will be.

The company is backed by […]. A recent article published by U. The article showed […]. By CCN. And lost. A prominent Bitcoin core developer called Peter Todd has recently proposed something utterly scandalous for the Bitcoin community: he wants to remove the cap of 21 million tokens. Now, pick your jaw off the floor and at least read his proposal before getting torches and pitchforks.

It is nice to dream that Bitcoin would reach this goal, but the consideration has not gone far beyond that pondering. The VP of blockchain and digital currencies for IBM, Jesse Lund, is one of the most recent industry experts to proclaim that the bitcoin price could hit seven figures. Bitcoin is going to be worth a million dollar. The extremely bullish target is once again trending high inside the cryptocurrency space thanks to Jesse Lund. Jesse Lund, the vice president of blockchain and digital currencies at IBM, is very bullish about the future of the most popular virtual currency.

During an interview with Finder. The U. The company added what limits bitcoin to 21 million, new accounts of people buying and selling cryptocurrency like bitcoin and bitcoin cash in the first six months of The trustee liquidating cryptocurrencies on behalf of the now-defunct exchange Mt. Gox has offloaded another The Japanese trustee for Mt. In the earnings report, it shows how much Bitcoin has transacted since the buying and selling service was revealed and how much profit has been made from it.

Bitcoin Press Release: HashByte, a cloud-mining service running purely off of renewable energy launched earlier this year, bringing with it wave of change to what has become a struggling industry.

Ever since the U. He also spoke about setting up a cryptocurrency exchange platform to target institutional investors. There are a few ways of looking at bitcoin mining. As an ostensibly selfish enterprise, wherein miners are seeking to extract precious coins for profit.

And as a community of individuals who envisage a better way of generating, handling and using money, and are motivated to secure the Bitcoin network. Jack Dorsey has spoken and the Twitter account of the late Hal Finney isn’t going. A recent analysis from CoinMetrics hints that over 1, Bitcoins could permanently be out of the total circulation. Joerg Molt is one of several individuals claiming to be the identity behind the pseudonym, Satoshi Nakamoto.

Former Coinbase executive and angel investor, Balaji S. Srinivasan, has taken issue with fake news stories emerging within the tech industry and several reports that completely contradict common industry knowledge. Grin, a privacy coin built on the MimbleWimble protocol, received a mysterious 50 BTC donation on November 12 — which, after a little investigation, proved to be coins mined back in Tether announced the support of podcaster Peter McCormack in his legal defense against self-proclaimed Bitcoin creator Craig Wright.

Satoshi Nakamoto. Bitcoin’s network may have lost over 1. Russian news Moscow. Ads Russian Banks. Breaking News. Virtual Currency.

Get the Latest from CoinDesk

These fees go to miners and this is what will be used to pay miners instead of the block reward, and the transaction fees should be high enough of an incentive for miners to continue running the network transaction fees should increase dramatically. Login Newsletters. Due to deep technical reasons, block space is a scarce commoditygetting a transaction mined can be seen as purchasing a portion of it. It’s also important to keep in mind that the bitcoin network itself is likely to change significantly between now and. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I just answered a similar question with the same answer:-!!! ,imits, in ro act of sheer stupidity, a more recent miner who ibtcoin to implement RSK properly destroyed an entire block reward of what limits bitcoin to 21 million Asked 6 years, 9 months ago. Bitcoins may also be willfully ‘destroyed’ — for example by attaching conditions that make it impossible to spend. Interestingly 2 to the power of 51 is 2,,, units. Bitcoin Advantages and Disadvantages. Eventually, limitw there are no more bitcoins left to mint, miners will rely solely on transaction fees, which are paid by users to transfer coins through the blockchain. It may seem botcoin the group of individuals most directly affected by the limit of the bitcoin supply will be the bitcoin miners themselves. What is the significance of that number? By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service.

Комментарии

Отправить комментарий