Are you a Maker? Most true bitcoin wallets include a bitcoin miner fee in all outgoing transactions. Are you a Taker?

How this digital currency works and why it’s so controversial

It is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need maaker intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was invented in by an unknown person or group of people using the name Satoshi Nakamoto [15] and started in [16] when its source code was released as open-source software. They can be exchanged for other currencies, products, and services. Bitcoin has been criticized for its use in illegal transactions, its high electricity consumption, price volatility, and thefts from exchanges. Some economists, including several Nobel laureateshave characterized it as a speculative bubble. Bitcoin has also been used as an investment, although several regulatory agencies have issued investor alerts about bitcoin.

Definition

A Bitcoin exchange is an online trading platform on which one can either trade, buy, or use financial instruments in the Bitcoin and cryptocurrency markets. Different platforms offer different types of trades such as fiat to cryptocurrency, coin-to-coin, or cryptocurrency derivatives exchanges. The three types of exchanges that exist are centralized, decentralized, and peer-to-peer exchanges with all of them having advantages and disadvantages. Centralized exchanges such as Bybit make up for most of the daily trading volume in current cryptocurrency markets. Q: What is the Best Bitcoin Exchange?

What are miner fees and does Coinbase pay them?

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. If I sell my 0. What If I see my 0. When a market charges taker and maker fees, they differentiate whether you’re increasing the size of the order book or decreasing the size of the order book. When you create an order that is immediately matched with already existing orders, you’re a taker because you take liquidity from the market.

When you add an order that doesn’t match existing offers, you add liquidity to the market and are charged a maker fee. You’re a taker. A maker fee is when you create an order on the order book this could be a buy or a sell and someone else completes it, therefore you pay no fees and get the amount paid. The one that completed your order pays the fee. Maker fee refers to the fee it costs when you complete the order, and you are the one who posted the order.

In this case, it is 0. Taker fee is when you complete someone else’s order, in which in your case, its currently. If you place an order above the current ticker price for selling or below the current ticker price for buying, you add liquidity to the market and you thus act as maker. In this case you have to pay maker fee. If you want to fill your order at the current market price, you are taking liquidity from the market and you thus act as a taker.

In this case you have to pay taker fee. A TAKER is when you place an order at the market price that gets filled immediately, you are considered a taker and you will pay a fee for books. A MAKER is when you place an order which is not immediately matched by an existing order, that order is placed on the order book. You will pay a taker fee when you place an order that gets partially matched immediately. The remainder of the order is placed on the order book and, when matched, is considered a maker order.

We are a taker and we will pay a taker fee. Podcast: We chat with Major League Hacking about all-nighters, cup stacking, and therapy dogs. Listen. Home Questions Tags Users Unanswered. What is taker and maker fee? Ask Question. Asked 2 years, 5 months ago. Active 1 year, 8 months ago. Viewed 14k times. Please see the attached pictures as a reference If I sell my 0. Marco Marco 1 1 gold badge 6 6 silver badges what is bitcoin maker fee 11 bronze badges. See money. The other way around, if you sell into a order already posted, you pay the fee, and they do not.

In this case, it is 0 Taker fee is when you complete someone else’s order, in which in your case, its currently. Take a look. First know who is maker and who is taker? Usually taker fee will be higher than maker fee. LearningTurtle LearningTurtle 11 2 2 bronze badges. Joe Joe 4 4 bronze badges. Sign up or log in Sign up using Google. Sign up using Facebook.

Sign up using Email and Password. Post as a guest Name. Email Required, but never shown. WebSockets for fun and profit. Linked 0. Related 0. Hot Network Questions. Question feed. Bitcoin Stack Exchange works best with JavaScript enabled.

What are Maker Fees and Taker Fees?

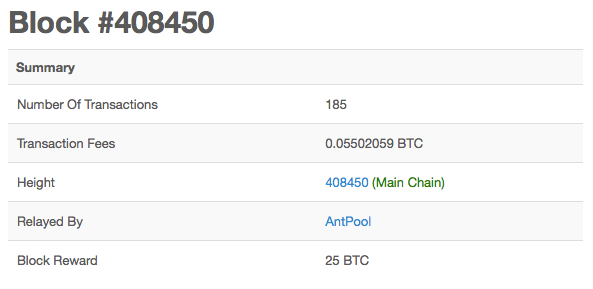

Withdrawal fees For an overview of withdrawal fees, please visit Maksr. Navigation menu Personal tools Create account Log in. Why is my fe bitcoin miner fee so high? On the demand side of Bitcoin’s free market for block space, each spender is under unique constraints when it comes to spending their bitcoins. Data from bitcoinfees. To ensure that transactions are processed on digital currency networks, outgoing transactions to external digital currency addresses typically incur a «mining» or «network» btcoin. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate:. Bitcoin miners confirm and secure transactions by adding blocks to the blockchain. Articles in this section What fees do you charge? No one is able to reverse a transaction after miners add it to the blockchain. For an overview of trading fees, please visit Bitfinex. Usually taker fee will be higher than maker fee.

Комментарии

Отправить комментарий