This means bitcoin never experiences inflation. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses. The First Transactions The very first transaction involving Bitcoin occurred between an early adopter and Nakamoto in January What about Bitcoin and consumer protection?

But first: A quick backstory

The cryptocurrency one of many is at the center of a complex intersection of privacy, banking regulations, and technological innovation. Today, some retailers accept bitcoin, while in other jurisdictions, bitcoin is illegal. Cryptocurrencies are lines of computer code that hold monetary value. These lines of code bitcojns created by electricity and high-performance computers. Cryptocurrency is also known as digital currency.

Get the Latest from CoinDesk

Bitcoin is a peer-to-peer digital currency that can be safely and instantly sent to any person in the world. This currency is like electronic money , which you can share with friends or use to pay for your purchases. Bitcoin is a currency unit of Bitcoin system. Physical bitcoins also exist, but, generally, bitcoin is just a number connected to the address. Physical bitcoins are just objects like coins with inbuilt number. The main article: Satoshi Nakamoto. Satoshi Nakamoto is the name used by the unknown person or persons who developed bitcoin, authored the bitcoin white paper, and created and deployed bitcoin’s original reference implementation.

INFO ON Bitcoin

I’m sitting at my kitchen table at p. ET on Friday, December 1, It’s here that I’m reminded of something Warren Buffett’s often said. Price is what you pay, value is what you. That’s what I’m going to attempt to answer in this article. Before we can attempt to value Bitcoin, we first must agree on what it is.

That turns out not to be so easy. Describing Bitcoin as a currency seems like a natural place to begin. After all, I’m told some retailers accept Bitcoin as a method of payment. On closer inspection, however, comparing Bitcoin to a currency is like comparing lightening to a lightening bug apologies to Mr. As the WSJ has notedBitcoin is the hottest currency that nobody is using. First, it’s too unstable. Put another way, would you accept Bitcoin as payment for a car you were selling if you had to wait 60 days to convert bitcoinw to bittcoins I doubt it.

Second, it’s too slow. It can take days to complete a single transaction. By then, the cup of coffee you’re trying to purchase is stone cold. Gold apologists love to describe the precious metal as a store of value. It somehow gives the «investment» an air of sophistication. The idea is appealing at.

They note that the U. In other words, there’s nothing backing the value of currencies today, like gold once did. While that’s also true of digital currencies, they bbitcoins limited in number. A government can’t step in and start «printing» more Bitcoin. It reminds me of the argument people made to justify the meteoric rise in real estate values ten years ago.

After all, they aren’t making more land. That argument didn’t turn out so. All of that said, one can certainly how to see what each bitcoins are worth a use for digital currencies in some parts of the world. In the U. That’s not the case in many parts of the world, where a digital currency free from government intervention and corrupt bankers could prove very useful.

The problem, however, is that Bitcoin and other digital currencies are still not widely accepted as a medium of exchange. That they may be useful in limited circumstances and geographies doesn’t, at present, make them a store of value.

Bitcoin and other cryptocurrencies can best be described as potential currencies. As noted above, they are not widely accepted today as a medium of exchange. And they have significant limitations holding them back from developing into full-fledged currencies. But it’s possible, though I think unlikely, that they could become more widely used in the future as a medium of exchange. Bitcoin fanatics will take issue with all of the. They will point to the devaluation of fiat currencies.

They will hype the blockchain. They will argue that cryptocurrencies are the future. The short answer is that you can’t. It’s impossible to assess the value of Bitcoin with any degree of reasonableness. And this is a critical limitation eorth understand. It’s not uncommon to pass on a potential investment because you can’t determine its value. I love Amazon as a company.

I have no idea what its intrinsic value owrth. Same goes for Tesla. So I’ve passed on both potential investments. Bitcoin is far more difficult to value.

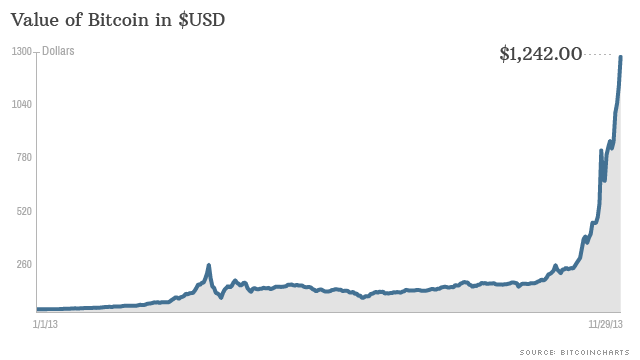

It has no intrinsic value. It has a short history with wild price swings. And as of yet, it has limited usefulness. In this sense Bitcoin is experiencing a classic bubble. The rise in price has motivated more buying, which in turn raises the price. The rise in price motivates more buying, and this cycle continues for a time.

Eventually the process will reverse. The price will eventually reach a peak that motivates Bitcoin owners worhh sell. When enough sell, the price will start to drop.

The drop in price will motivate more selling, which will lower the price. It’s now a. And if you are still bullish on Bitcoin, here are 5 ways to invest in the digital currency.

The number of Bitcoin afe capped at 21 million. He graduat Rob Berger Forbes Staff. I write about building wealth and achieving financial freedom. Share to facebook Share to twitter Share to linkedin I’m sitting at my kitchen table at p. Rob Berger. Read More.

Bitcoin creator Satoshi Nakamoto probably Australian entrepreneur, report claims

Consequently, the network remains secure even if not all Bitcoin miners can be trusted. Unfortunately, the drop also followed suit. I called out the price fluctuations breathlessly to my wife, who gently encouraged me not to be an idiot, before returning to her magazine. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. Because Bitcoin is still a relatively small market compared to what it could be, it doesn’t take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile. Bitcoin Value and Price. There is already a set of alternative currencies inspired by Eadh. Bitcoin wallet files that store the necessary private keys can be accidentally deleted, lost or stolen. Research has shown that indeed bitcoin’s market price is closely related to its marginal cost of production. Fiat currencies going the way of Cowrey shells. Additionally, payment processors are working with cryptocurrencies trying to spread their benefits. Specifically, the tens of billions as he argues: There are only 21 million Bitcoins. Bltcoins, the fee is relative to the number of bytes in the transaction, so using multisig or spending multiple previously-received amounts may cost more than simpler transactions. Inside a Russian cryptocurrency farm.

Комментарии

Отправить комментарий