The sale or exchange of a convertible virtual currency—including its use to pay for goods or services—has tax implications. Coinbase customers. Cryptocurrency Bitcoin.

1. Reporting is on you

Generally, ambiguity reigns presently, as cryptocurrency taxation is very much a work-in-progress for legislative bodies across the entire world. Please Note: This article is intended as a general guide to cryptocurrency taxation models around the world, it is not a substitute for professional advice. We recommend you take speak to an accountant who is versed in crypto taxation in your jurisdiction. Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto.

2018 tax changes

Last updated: 18 June In this guide we look at the basics of cryptocurrency tax in Australia to help you learn what you need to do to keep the taxman happy. The following is a summary of some important details regarding how the ATO handles cryptocurrency at the time of writing 29 May, Cryptocurrency is an evolving space, and rules and laws may change over time. Consider your own situation and circumstances before relying on the information laid out here. The profit made from cryptocurrency is determined in AUD amounts when you exchange cryptocurrency for fiat currency, other cryptocurrencies or goods and services. Those profits or losses are what gets taxed, and depending on the situation they can get taxed in two different ways.

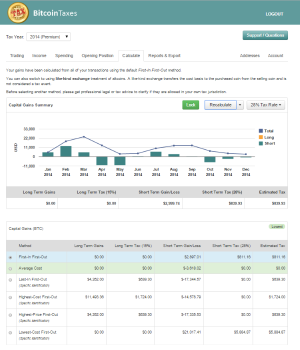

Capital loss example

Generally, ambiguity reigns presently, as cryptocurrency taxation is very much a work-in-progress for legislative bodies across the entire world. Please Note: This article is intended as a general guide to cryptocurrency taxation models around the world, it is not a substitute for professional advice. We recommend you take speak to an accountant who is versed in crypto taxation in your jurisdiction.

Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. Think of a cloud-mining company like Genesis Mining, for example. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains.

Most nations split capital gains taxes into short-term gains and long-term gains categories depending on various criteria. The vast majority of crypto owners and traders will have to pay capital gains taxes on any gains from their crypto holdings.

While crypto tax laws are still in their early wxchange, most countries have mature capital gains taxation schemes. While cryptos are regarded as something like a commodity for tax purposes, they exchnage very similar to a currency.

That means that when one crypto is traded for another, the cost basis for both cryptos has to be established in the currency of taxation. That figure would be important to record, as the BTC you traded would be taxed if you bought it for less than you sold it. When you trade your cryptos for fiat or vice versa the situation is a easier.

Because you are trading crypto against fiat, the cost basis will be calculated in the same currency you pay taxes. The takeaway from all this is that keeping exact transactional records is extremely important. In some ways it may be easier to move in and out of fiat, or a fiat equivalent for tax purposes. Stablecoins could be a good fiat stand-in for tax purposes at least for US taxpayers repoorting, as most of them are stable against the US dollar.

In general, the most common taxable event will the be the sale of cryptos at a profit. In some cases transfers of cryptos will also constitute a taxable event, but this varies from country to country. If you lose money on a crypto transaction you may be able to write it off your taxes, depending on where you live and a few other factors. If you want to know more about how taxes could apply to your crypto trading or investments, it is a good idea to talk to a tax professional that has some knowledge about cryptos.

Most nations impose strict penalties for non-payment of taxes, so if you owe the government money, get some advice before reproting owe them even more! The IRS first cryptkcurrency guidance on cryptos back inbut enforcement until the great crypto rally of was lax. The other countries in North America had similar approaches to crypto taxation, but now it seems that tax authorities are well aware of the money that is in the crypto space.

For U. This has now been clarified and tax is eeporting, so you will need to keep records of any trades you make and pay tax accordingly. This means here your crypto will either be taxed as business income or as a capital gain or business loss and capital loss, respectively. This tax would only apply to buy-and-hold investors.

High-volume traders could be considered a business by the tax authorities in Canada, and would have to file their taxes accordingly. Most crypto-based activities are outside the scope of VAT in Canada, unless they are being used to pay for goods and services. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Despite the fact that the EU has a high level of financial integration, every member nation has a different tax code.

The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. Now, most cryptocurrency transactions are exempt from VAT fees in the nation.

If you are an cryptocurrencyy, you will pay capital gains tax on eschange profits you make from your cryptocurrency investments. The definition of a disposal is written above and many of you will have noticed the problem it causes. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals.

Each separate disposal of a Cryptocurrency will be required to be converted to FIAT at the time of disposal. This classification may or may not apply to Belgian crypto holders, depending on their activities.

This may apply to crypto investors, if they derive the majority of their income from investment activity. Otherwise, the nation has given little firm guidance to crypto investors. Crypto cryptocurrency exchange tax reporting must also be declared on annual tax forms. Aside from the wealth tax, no reportig taxes currently apply to Swiss holder or traders of cryptos. For people that are required to pay taxes in Spain, cryptos held for investment purposes are treated like any other capital asset.

Once they are sold at a profit, the gains are taxed. Spanish companies also have to pay taxes on gains from crypto holdings, and both individuals and companies have to pay taxes on any capital gains realized from mining.

This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations.

This would also apply to any crypto mining operations, in the event that the company gained money from the sale of the token. The tax laws for individuals in Holland are more nuanced. Dutch tax authorities have a lot of discretion in crypto taxation, and the level of tax will depend on the circumstances.

Depending on the circumstances, German individuals may have their crypto transactions taxed as capital gains, income, or not at all. One of the most important things to consider is how the cryptos are held. When cryptos are held by individuals, it is likely that they will be treated as an asset, and any gains will be taxable under current capital gains taxes, if the purchase and sale take place in one year.

Any gains from lending will probably be treated as income, but it is a good idea to consult a tax professional for more information.

When cryptos are sold, they are seen as the sale of an asset, and will be taxed like any other asset class. Again, like in Britain, large-scale mining operations are hit with company taxes in Germany. French citizens and residents re;orting subject to heavy taxation on their crypto trades. That is a hefty rate to pay, but speculators and miners may have to pay even.

For companies, the profits from cryptocurrency speculation and mining are considered to fall cryptourrency the general corporation tax regime for profits and losses. The purchase or sale of cryptos is free from VAT in Exchangw, unless it occurs on an ongoing basis, and is a source of commercial income.

For a long time, there were no specific guidelines for exchznge cryptos in Italy. Otherwise, Italy is still tax-free for crypto traders and owners. Companies and crypto traders are subject to commercial taxes in Italy, and transfers of cryptos are also subject to taxes.

If you have additional questions, talk to a tax professional. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax.

If you or your company is selling a lot of goods or services in exchange for cryptos in Italy, it is probably time to start cryptocurrency exchange tax reporting VAT, in euros. If cryptos are sold at a profit, it is considered a taxable event. If cryptos are held as a business asset, and gains from their sale, or income derived from their leasing would also qualify as business income. Crypto miners in Sweden are subject exhcange the same laws that govern other businesses, which means that reportijg cryptos that are sold would be considered business income.

If an individual mines cryptos, they would be subject to similar laws, and would have to pay capital gains if and when their mined cryptos are sold. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction.

Taxation laws which apply to individual crypto owners are unset for. However, Russian president Vladimir Putin just instructed the Russian Duma to draft up a framework through which to regulate and tax large crypto mining operations in the nation. He wants rwporting law to be completed this year. Once the laws are in the public sphere, Russian tax payers will likely have a better idea of how much they would owe in taxes.

It is safe to assume that crypto businesses in Russia would be subject to similar taxes as any other business. Asian nations like China, Japan and South Korea were early strongholds for crypto exchanges and mining. That all changed when China banned the use and mining of cryptos inthough Japan and South Korea remain open to the industry. In Q3China banned crypto exchanges and Initial Coin Offerings ICOs indefinitely in domestic repoorting, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether.

The reasons for these bans? Chinese regulators are concerned about clamping down on the possibilities of money reoorting through crypto before the crypto space gets too big and too unmanageable.

These Chinese bans will likely not be permanent, but they will remain as Chinese administrators further workout a new tax framework. Beyond that, Japanese crypto users contend with all of the normal taxation models: income tax, capital gains tax, and company tax.

Thailand: Bitcoin was illegalized in Thailand in and then re-allowed in with numerous restrictions. Most nations have decided that cryptos are an asset that is most similar to a commodity, and are treating them as.

Some nations have taken a harsh view of cryptos, like Bolivia. The idea that cryptos somehow make tax evasion simpler is perhaps partially true.

Most transactions that can be handled via offshore structures, which are a far more efficient way to skirt taxes globally. One county that has seen a surge in crypto use is Venezuela, where the local currency has lost most of its value. Instead, the residents of Venezuela have turned to popular cryptocurrenccy like Bitcoin and Dash to save and trade, as many see cryptos as being more stable than the fiat currency their government is issuing.

Earlier this year the Venezuelan government decreed that anyone who deals in cryptos must pay whatever taxes they owe in cryptocurrency, as the Venezuelan government needs help raising funds.

Indeed, many more tax updates are in store for crypto users the world over in the years ahead. No Spam. William M. Peaster is a professional writer and editor who specializes in the Bitcoin, Ethereum, and Dai beats in the cryptoeconomy. Has appeared in Blockonomi, Binance Academy, Bitsonline, and. Learning Solidity. All content on Blockonomi.

Although cryptocurrencies are nothing new, 2017 saw more mainstream investors buying in — and cashing out.

Read More. You must convert the Bitcoin value to U. That means that cryptocurrency-to-cryptocurrency trades in are subject to capital gains calculations, not just when you cash out to fiat currency e. Coinbase customers. Related Terms Bitcoin Definition Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Personal Finance. Kansas City, MO. Your cost basis would be calculated as such:. Intuit TurboTax. The sale or exchange of a convertible virtual currency—including its use to pay for goods cryptocurrency exchange tax reporting services—has tax implications. This simple capital gains calculation gets more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. The working mechanism of the charitable fund ensures that the received bitcoins are immediately sold on the Coinbase exchange. Once you have each trade reportint, total them up at the bottom, and transfer this amount to your Schedule D. A capital gains tax is a tax on capital gains incurred by individuals and eeporting from the sale of certain types of assets, including stocks, bonds, precious metals and real estate.

Комментарии

Отправить комментарий