Related Articles. This increases the risks associated with those derivatives. A broader approach to crypto markets beyond bitcoin will raise awareness of alternatives. Personal Finance. Cryptocurrency has only attracted marginal interest, so far. Good logic, but not necessarily true in practice.

Trade Bitcoin Derivatives:

Bitcoin derivatives are more in demand than ever, as bitcoin company executives seek a way to hedge balance sheet risk. A liquid futures and options exchange for bitcoin will provide commercial hedging opportunities as well as increase overall price stability. This is not disputed. What will bases contentious, however, are the paths and methods necessary to get. In this article, I examine exchange structure, exchange jurisdiction, the practicality of various contracts, and existing bitcoin futures markets. Derivatives obtain their name from the fact that they are instruments derived from an underlying spot commodity or index. In theory, the spot price of the physical commodity underlies and derivarive the basis for pricing in the futures market due to the explicit option for physical delivery.

One Year Bitcoin Options Are Now Available

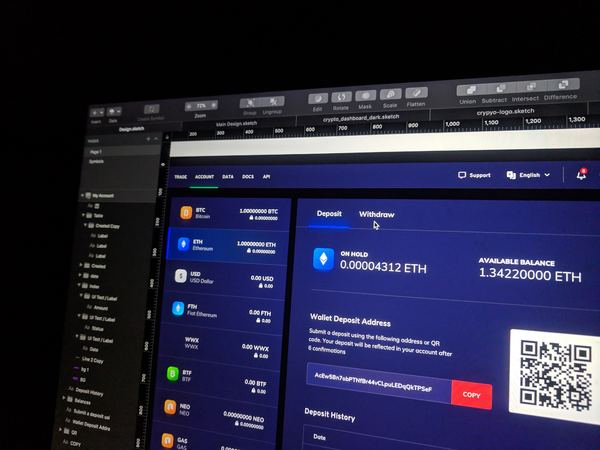

A Bitcoin exchange is an online trading platform on which one can either trade, buy, or use financial instruments in the Bitcoin and cryptocurrency markets. Different platforms offer different types of trades such as fiat to cryptocurrency, coin-to-coin, or cryptocurrency derivatives exchanges. The three types of exchanges that exist are centralized, decentralized, and peer-to-peer exchanges with all of them having advantages and disadvantages. Centralized exchanges such as Bybit make up for most of the daily trading volume in current cryptocurrency markets. Q: What is the Best Bitcoin Exchange?

Trading Bitcoin Options Futures And Derivatives: What You Need To Know

Top Stories

Ask yourself: is the disappearance reflected in the hulking bulk of trading activity? Instead of buying a put option, the investor could short Bitcoin. Banks are paying attention, as are government regulatory and tax agencies. Thereby settling your account with the third parties. Alex Wang Mar Dave Kranzler of Investment Research Dynamics thinks that futures can be used to manipulate the price of bitcoin. Derivatives rhyme with derlvative, which essentially allows you to do more with. Your Practice. In short, you could be SOL. In turn, this could result in less volatility in their prices. The regulator also asks retail brokers to warn their customers of the risks of investing using derivatives products, across all asset classes. Adam B.

Комментарии

Отправить комментарий