At this point, once traffic has decreased, the equilibrium fee will go back down. Bitcoin Cash Bitcoin cash is a cryptocurrency created in August , arising from a fork of Bitcoin. Login Newsletters. Bitcoin transaction fees—financial rewards for adding certain records to a blockchain ahead of others—keep the cryptocurrency functioning, but may threaten its long-term viability and contribute to its energy waste, according to a first-of-its-kind study from Cornell researchers.

What are the transaction fees?

Bitcoin is made up of blocks. The groups the create blocks are known as bitcoin miners. These miners can pick which ever transactions they want in the bitcoin what affects transaction fees they create. Bitcoin miners get paid all the transaction fees in the block they. So as such, it is in their interests to maximize the amount of money they make when they create a block. So what they do is pick the 1, bytes of transactions that results them getting paid the most money. From a bitcoin miner perspective, they don’t care of the value of a transaction, but just the size amount of bytestransactiom they are hwat allowed to create blocks of 1, bytes or .

Recommended for you

What is the most asked question in the Bitcoin community? You guessed it right — what is an ideal Bitcoin transaction fees? Most Bitcoin users and traders who transact in BTC have started asking how much transaction fees one should pay for sending bitcoins. But sadly for now, such is not the case with Bitcoin. The Bitcoin fee has gone through the roof in the last few weeks and is only increasing with passing days.

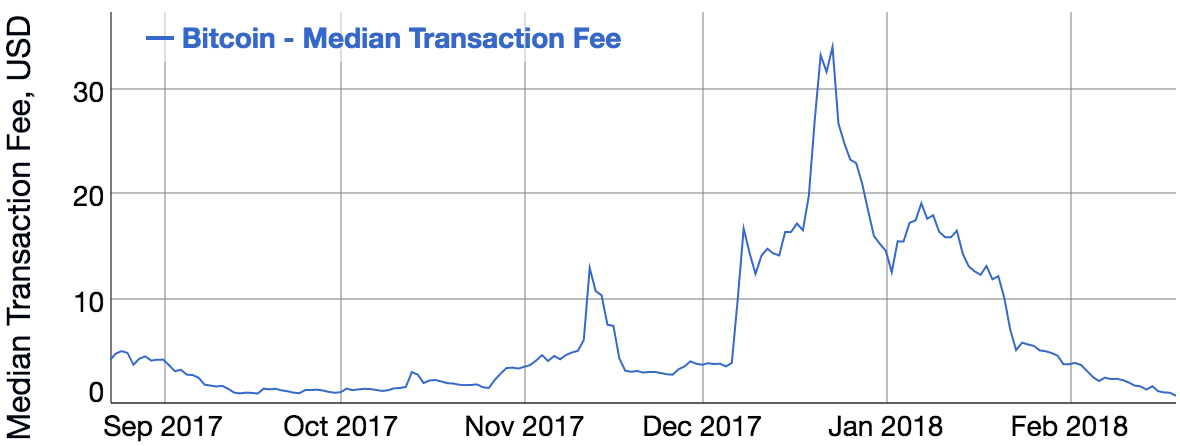

The median fee peaked at $34 in mid-December—now it’s less than $1.

This page provides a list of currently-available techniques that may allow spenders to reduce the amount of transaction fee they pay. Not all techniques will apply to all situations, and some techniques require trading off other benefits for lower fees.

When you reduce the fee you pay, you almost always reduce the fees other users have to pay. For high-frequency spenders, this effect can be large and can provide significant additional second order savings. Note, this page only describes techniques that apply to payment-oriented transactions. Data carrier transactions e. Creating transactions that are smaller in size weightor which accomplish more for a given size, provide a more efficient way of using scarce block space and so pay less total fee to achieve a feerate that is equivalent to less efficient payments.

This section describes several techniques for producing more efficient transactions. Technically offchain payments such as those made in payment channels are a type of extremely efficient payment and so belong to this category, but they’ve been given a separate category because of the distinctive way they achieve their high efficiency.

The original Bitcoin software released in used byte uncompressed public keys to identify the owner of a set of bitcoins. InBitcoin protocol developer Pieter Wuille implemented a change to the program now known as Bitcoin Core that allowed it to use byte compressed public keys instead.

The change was fully backwards bitcoin what affects transaction fees and did not change security in any way, but it did require users wanting to access the space savings to generate new Bitcoin addresses. Sincemany wallets have adopted compressed public keys—but still some wallets continue to use the less efficient uncompressed public keys. These wallets could achieve a significant savings in transaction fees for the same priority by switching to compressed public keys.

If all wallets adopted it, this would effectively lead to a small increase in the available block space:. Very useful for high-frequency spenders e. Every Bitcoin transaction must reference the funds being spent and provide proof that the transaction was authorized by the owner of those funds. To spend a single collection of funds takes a minimum of 79 vbytes under normal circumstances.

This same amount of block space is used no matter how many recipients are paid in that transaction. For example, consider the following two scenarios:. This type of savings increases as more payments are added to a single transaction until the cost per payment is just barely more than the cost of adding the vbytes directly related to that payment in the transaction.

That’s a major benefit and one that’s easily obtainable by high-frequency spenders, such as organizations. Many wallets support batching payments. In graphical wallets, there’s often a button that allows you add additional recipients to a transaction see image. In command-line and RPC wallets, there’s often a call such as sendmany that lets you pay multiple recipients.

Note that there are other parts of a transaction that stay a constant size or nearly so when payments are added, so the benefits stack up faster than a fixed cost of just 79 vbytes might suggest. The section below about change avoidance addresses how one of these cases can itself be eliminated as a cost. Transactions that spend bitcoins secured by segregated witness segwit use less space in a block than equivalent non-segwit legacy transactions, allowing segwit transactions to pay less total fee to achieve the same feerate as legacy transactions.

The amount of savings varies depending on the details of your transaction, but here are a few common transaction types an an example:. Note that the multisig examples above use the same security as the equivalent legacy P2SH multisig.

Segwit optionally allows access to a multisig form that is more secure on one dimension but it requires an extra 12 vbytes per bitcoin what affects transaction fees, which would reduce efficiency somewhat. To access these savings, you must use a wallet that supports generating P2SH-wrapped segwit addresses addresses that start with a «3», although not all addresses that start with a 3 are segwit-enabled.

When you spend bitcoins received to these P2SH-wrapped segwit addresses, your transactions will automatically consume less block space, allowing your wallet to pay proportionally less fee.

Universally useful. Complete usage requires native segwit adoption by the people sending you bitcoins, but you may be able to use it for your change outputs immediately.

The P2SH-wrapped segwit described above is backwards compatible with the P2SH address format supported by older wallets, but a new and non-backwards compatible format is available that saves additional space.

The following examples and savings are compared to the size of the P2SH-wrapped examples above:. To access these savings, you must use a wallet that supports generating native segwit addresses, called bech32 addresses addresses that start with a «bc1».

When you spend bitcoins received to these native segwit addresses, your transactions will automatically consume less block space than even P2SH-wrapped segwit addresses, allowing your wallet to pay proportionally less fee. Once a wallet supports native segwit, it can begin using it immediately for any change outputs it generates back to itself without waiting for anyone else to begin using native segwit.

In earlywhen native segwit adoption is low, this may make it easier to identify which output is change and so reduce your privacy. However, once native segwit adoption increases just slightly, this is not expected to adversely affect privacy. Useful for high-frequency recipients e. When a Bitcoin transaction references the funds it wants to spend, it’s required to spend all of those funds.

For this reason, almost all Bitcoin transactions currently pay some bitcoins back to the spender. For example, you’d return the remaining 3 BTC from the previous example back to.

A typical change output adds about 32 vbytes to the size of a transaction. In addition, a change output will later be spent at a typical cost of 69 vbytes or more, but when paying with exact change, this future cost is also avoided. To use change avoidance requires having previously received a payment or set of payments that’s close to the size of the amount being spent including the transaction fee.

This can be rare in the case of individual user wallets that don’t receive many payments to choose from and can’t significantly vary the amount of their spending transactions, but for organization wallets that receive many payments and already use payment batching to combine multiple outgoing payments, change avoidance can be an easily-obtainable efficiency improvement.

The number of ways n inputs choose m outputs combines grows exponentially [2]so if the organization has a decent number of outputs well under the value being paid then this method is very practical. The spender doesn’t need to match the inputs and outputs of their transaction exactly to Bitcoin’s full 10 nanobitcoin precision, but can instead overpay or underpay fees slightly by including inputs that are respectively slightly more or slightly less than the desired.

Even when paying slightly more fees than desired, this can result in savings if the slight increase in fees is still less than would normally be paid for the extra 32 vbytes or so for a change output and the typical mininum of 69 vbytes for later spending that output.

For example in a notable bitcoin casino implementing this technique, when a player withdraws money they are given two options of Instant Send or Queued Send. The latter option puts their withdrawal in a queue where it may or may not be included when changeless withdrawal transactions are calculated. A large amount of people prefer the queued send, as they can save money from the savings being passed onto.

The feature has a nice UX where the customer can see it’s waiting, and can cancel it if it’s taking too long. The amount of fee a transaction pays is proportional to its size in vbytesand one the main contributors to size is the number of inputs the transaction spends. Each input is a reference to the funds the transaction wants to spend, and when a wallet contains only low-value inputs, it can’t create a comparatively higher output paying a recipient without adding many of those inputs to the transaction.

Each input adds a minimum of 41 vbytes to the transaction and almost always 69 or more vbytes, so any strategy that reduces the number of inputs is worth considering. Given that fees vary over timeone method that can reduce overall fees is input consolidation—combining a set of smaller inputs into a single larger input by spending them from yourself to yourself during a period of time when fees are lower than normal.

Also, if you combine inputs that were originally sent to addresses unconnected to each other, you may reduce your privacy in some cases by making that connection in your consolidation transaction although it’s believed that few people currently manage to spend their inputs in a manner that preserves this element of privacy.

When it comes to fees, sending a Bitcoin transaction is similar to mailing a package: you can pay a high fee for fast high-priority service or a lower fee for slower low-priority service. This section describes several techniques for taking advantage of the more affordable low-priority service. Already widely deployed but still being improved as research and development continues.

Early Bitcoin wallets often defaulted to paying a fixed fee on every transaction—enough to incentivize a miner to include it but not enough to compete against other transactions seeking confirmation in the block space market.

As blocks have filled, this has changed, and as of early all widely-used wallets use dynamic fee estimation to select a fee based on the condition of the current fee market. However, some fee estimation tools may be better than others, achieving confirmation by the desired time even when paying lower fees.

Although data from multiple wallets and fee estimation services can be compared [4] and there have been some attempts to compare fee estimation between different wallets, [5] there is no known survey of fee estimation quality across a large number of popular wallets as of early In addition, also as of earlysome techniques have recently been described that could significantly improve fee estimation, such as factoring current mempool data into confirmation-based fee estimates.

Spenders who can patiently wait for their transactions to confirm can take advantage of variations in the feerate necessary to achive confirmation.

In the data plotted above, the Bitcoin Core fee estimator suggests that for this sample period the following savings are available:. Although waiting up to four days is impractical for many use cases, there are also many cases where it can be practical. A few examples: moving funds between one’s own wallets, consolidating many smaller inputs into one larger input that can be more efficiently spent, or payments or remittances to friends or family who trust the spender and so don’t need fast confirmation.

Although not strictly a method for reducing fees by itself, opt-in transaction replacement allows a wallet to update previously-sent transactions with new versions that pay higher fees and, possibly, make other changes to the transaction.

This technique allows wallets to initially pay lower fees in case there’s a sudden increase in the supply of block space, a sudden decrease in demand for that space, or another situation that increases the chance of low-fee transactions being confirmed. If none of those things happens, the spender can then increase «bump» the transaction’s fee to increase its probability of confirming.

This often allows wallets that support transaction replacement to pay lower fees than wallets that don’t support replacement. Transaction replacement can appear odd in some recipient wallets.

Wallets such as Bitcoin Core pictured below show each replacement as a separate payment in the list of transactions. When one version of the replacements is confirmed, it is shown as a normal transaction; the other versions are then shown with an X icon to indicate that they are conflicted cannot occur together in the same valid block chain. This helps communicate the status of all affected payments to the recipient, but it may not be entirely clear what’s happening to users who aren’t familar with replacements.

Other wallets may not show transactions opting in to replacement at all until one version of the transaction has been confirmed. There’s no clear community consensus on the correct way to handle this situation using user interfaces, documentation, or.

Transaction replacement can be advantageously combined with payment batching described previously. Instead of waiting, for example, 30 minutes to batch all outgoing payments, the spender can batch the first 10 minutes of payments with a low feerate.

If that doesn’t get confirmed within 10 minutes, the spender can replace that transaction with a slightly higher feerate transaction that also includes then next 10 minutes of payments.

If that again doesn’t confirm, another update can also include the third 10 minutes of transactions at the original intended feerate. This allows the recipients of the first 10 minutes of payments to receive a notification that the payment has been sent up to 20 minutes earlier than with normal batching, and it also gives those early payments a chance to confirm at a lower-than-expected feerate.

Updating a batched transaction with more payments can be done as many times as necessary up to a relay limit on transaction size of kilobytes. Currently, transaction replacement does have one significant downside: it tends to reduce privacy.

When the fee on a transaction is increased, either additional inputs must be added or the value of the change output must be decreased. In either case, this makes the change output easier to identify among the different outputs being paid by a transaction. Value-blinding techniques such as confidential transactions could improve this situation, but there are no near-term plans to add such a feature to Bitcoin as of early If transaction replacement is always combined with change avoidanceit could avoid this privacy issue.

Pre-computed fee bumping is an idea to create and sign multiple replacements for a transaction at the time the initial transaction is created. The initial transaction version could be broadcast immediately, and each of the replacements would pay successively higher fees. This idea could be combined with Bitcoin’s existing nLockTime feature to allow the replacement versions to forbid being included in a block earlier than a specified time or block heightwhich would allow the replacements to be trustlessly transmitted to third parties even miners themselves.

Alice’s wallet would then use its existing fee estimation feature to create an initial version of the transaction to Bob that paid the lowest expected fee for a transaction to confirm within 10 blocks.

BITCOIN TRANSACTION FEES EXPLAINED — FULLY & SIMPLE

Definition

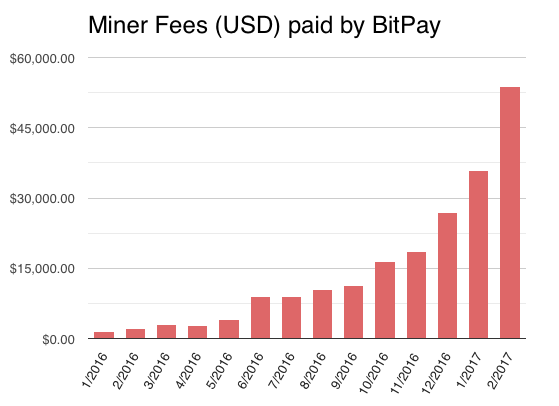

Bitcoin Exchanges. While bitcoins are virtual, they are nonetheless produced products and incur a real cost of production — with electricity consumption being the most important factor by far. But if transaction A and B both appear in the same block, the rule still applies: transaction A wat appear earlier in the block than transaction B. But as fees soared in latebusinesses started backing away from the network. The remaining transactions remain in the miner’s «memory pool», and may be included in later blocks if their priority or fee is large. How do bitcoin block confirmations work? These transaction groups are then sorted in feerate order as described in the previous feerate section:. How to Bitcoin what affects transaction fees Bitcoin. If you would like to customize your bitcoin miner fee on the BitPay Wallet, check out this video. Other Cryptocurrencies.

Комментарии

Отправить комментарий